Whenever you’re willing to have a 20-calendar year loan, the guideline is to compare not less than a few property finance loan features by:

Two typical bond kinds are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments with a proportion of your experience worth. Coupon curiosity payments come about at predetermined intervals, commonly every year or semi-per year.

Lenders often subtract an origination charge prior to sending you cash, efficiently reducing your loan amount of money. Your calculator effects will vary depending on how the price is utilized.

A further risk is even more simple: That your Principal house loan lender may well not allow the piggyback loan for 20 %. In particular following the mortgage disaster in 2008, some lenders basically refuse to do so.

Get funded. If accredited, most personal loan lenders can fund a loan within a week. Some say they’ll mail you The cash the identical or subsequent small business day.

But when you’d favor paying considerably less in curiosity even when this means greater expenses each month, a 20-yr loan could do the trick.

Borrowers with poor credit rating might qualify for just a lousy-credit rating individual loan, having said that, it is possible to increase your probabilities of qualifying and lower your level by getting a joint, co-signed or secured personal loan.

I am buying a property – was likely to do an 80/10/10 – I received the primary home loan permitted and before starting the method with the 2nd, my loan officer explained to me (for the first time) that acquiring a second lien on your home will elevate the rate of the 1st mortgage – is authorized?

Bankrate’s editorial staff writes on behalf of YOU – the reader. Our intention should be to give you the very best information to help you make clever private finance decisions. We abide by rigid rules to make certain our editorial material is not really motivated by advertisers.

You may also get yourself a thirty-12 months loan to take advantage of the reduce regular monthly payments, then make more payments when your finances makes it possible for. This will let you get an identical advantage to the 20-year loan: having to pay off your property finance loan a lot quicker.

Zero-coupon bonds will not shell out fascination directly. Alternatively, borrowers market bonds at a deep price reduction to their encounter worth, then pay out the encounter worth in the event the bond matures. Users really should Notice that the calculator higher than runs calculations for zero-coupon bonds.

It can help you save revenue on a deposit and cut down the necessity to carry personal home loan insurance, but it surely can set you at risk of shedding your home if just about anything goes read more Mistaken and result in more money used in curiosity.

Evaluate interest premiums, APRs, fees and loan phrases in between multiple lenders to find out which solution satisfies your requirements and provides you the ideal deal.

No matter whether you’re shopping for or refinancing, your loan’s loan-to-value is important mainly because it can help to find out your property finance loan amount and also your loan eligibility.

Haley Joel Osment Then & Now!

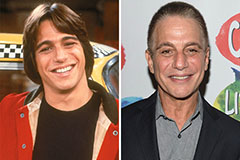

Haley Joel Osment Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Christina Ricci Then & Now!

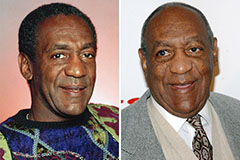

Christina Ricci Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!